IVA

An Individual Voluntary Arrangement (IVA) is a formal debt solution between you and your creditors which can be set up when you cannot afford to pay your debts. It allows you to repay your debts with affordable monthly payments, over a set period of time (usually 60 months). It is a legally binding agreement which offers you protection from creditors and can assist with writing off some of your unaffordable debt. On completion of your IVA, the outstanding balance of debts in the IVA will be written off. An IVA is individual to your circumstances, therefore the level of 'debt write off' will depend on your total debt, affordability and will be subject to the agreement of your creditors.

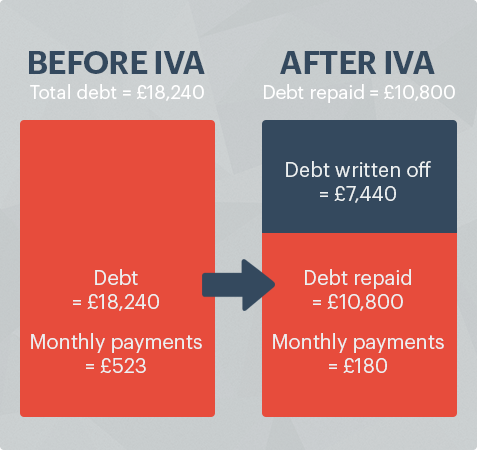

Example of an IVA

In the example below the individual contacted us explaining that they could no longer afford to pay their contractual payments of £523 per month on debts totalling £18,240. After determining if an IVA was suitable, we put forward their IVA proposal to the creditors, explaining that they could afford to pay £180 per month in the IVA. The IVA proposal was accepted by creditors. After the 60 monthly payments are made into the IVA, our client will have paid £10,800 back to their creditors. The remaining balance of £7,440 will be legally written off on completion.

| Unsecured Debts | |

|---|---|

| Credit Card | £4,842 |

| Credit Card | £2,687 |

| Credit Card | £3,241 |

| Loan | £5,125 |

| Payday Loan | £902 |

| Payday Loan | £643 |

| Overdraft | £800 |

| Total Debt | £18,240 |

Starting an IVA with us

An IVA is suitable for you if you have debts of approximately £8,000 or more owing to two or more creditors and can afford to pay at least £90 per month into the arrangement. In order to determine if an IVA is a suitable option for you, one of our advisors will contact you by telephone to talk about your situation and advise how you can deal with your debt. You will be asked for details about your income, outgoings, total debts and any other relevant information needed, in order to provide you with the best advice. You will then be given the choice to decide how you wish to deal with your debt.

If you wish to proceed with an IVA, you will require the assistance of a licensed professional called an Insolvency Practitioner (IP). An IP is the person who is legally qualified to prepare, negotiate and administer an arrangement on your behalf. All our IVAs are processed and managed by McCambridge Duffy Insolvency Practitioners, our sister company. There are 4 full time Insolvency Practitioners that work for the company allowing us to deal with everything in house.

The IP will prepare your IVA proposal document and issue it to creditors for their consideration. Creditors will then be invited to vote on your proposal, which will allow for negotiations between us and your creditors. An IVA can usually be set up within 4 weeks from the date you first contact Debt Solutions. Once the IVA is approved you are legally protected from your creditors and you can start your agreed monthly payments into the arrangement.

If you are interested in finding out more about an IVA, please phone us on 0800 043 0200 and one of our advisors will be happy to help.

Pros of an IVA

- Monthly payments based on what you can afford

- No upfront Fees

- Legal protection from creditors

- Interest and charges frozen on approval of your IVA

- We can set up an IVA in as little as 4 weeks

- Suitable for tenants or homeowners, individuals or couples, and even business owners

Cons of an IVA

- Your credit rating may be affected for up to 6 years

- Your details will be recorded on the insolvency register

- If your IVA fails, your creditors may request that you be made bankrupt.

- If you are a homeowner with equity in your property you may be required to introduce part of your share of this equity in the final year of the arrangement. If you can't get a remortgage, your arrangement can be extended for up to another year.

IVA Q & A

Below are a few of the frequently asked questions we are asked in relation to our IVAs. If you have any questions please feel free to get in touch and we will find the answers you need.

An IVA is an agreement to repay your debt at a level suitable for you and agreeable to your creditors. Each IVA is unique and tailored to your indivdual situation and has no 'set' criteria. To determine if you are eligible to propose an IVA, contact us.

- Loans

- Overdrafts

- Credit Cards

- Utility Arrears

- Council Tax Arrears and current year

- Catalogues

- Store Cards

- Payday loans

- Debts to family and friends

- Debts for professional services, i.e. solicitors, accountants, vets etc

- Some debts owing to HMRC for tax and national insurance arrears or tax credits overpayments

There are a few different types of IVA which can be proposed depending on your circumstances. Each of these IVAs have been outlined below.

Single IVA

A single IVA is a proposal solely in your name. It covers any debts in your name and any joint debts that you may have. The terms of the IVA will be dependent on your circumstances and the monthly payment will be based on your individual income and expenditure.

Interlocking IVA

An interlocking IVA is when two individuals propose separate IVAs that are mutually dependent on each other. When the IVAs are accepted they become interlocking and all creditors for both parties are paid from one joint monthly payment.

Lump Sum IVA

A Lump Sum IVA is usually a shorter term IVA with creditors receiving payment via a "one off" lump sum which may be money from a remortgage or family member for example. The duration of an IVA such as this can be as little as 12 months.

Assisted Payment IVA

This is usually a single IVA where you can receive assistance towards the monthly payment from their partner or spouse. As with a single IVA, it covers any debts in your name and any joint debts that you might have.

Self Employed / Sole Trader IVA

If you are self employed or operate as a sole trader then you can propose an IVA that will deal with both your personal and business debt, including any debts that you may owe to HMRC. This type of IVA could help your busines continue trading.

When you propose an IVA, your creditors are sent a proposal document to consider. They are invited to vote on this proposal at the "Creditors Meeting" to confirm if they are willing to accept your offer of repayment. At this meeting, if more than 75% (by debt value) of the total creditors who lodge a vote, choose to accept your propsal, then the IVA is approved and becomes legally binding on all creditors in the arrangement, including those that did not lodge a vote.

From time to time, some creditors may put forward modifications for you to agree to, before accepting your proposal.

Apply for an IVA

If you would like to discuss your options and find out if an IVA is suitable for you, then click here to fill in the IVA Application form. One of our advisors will be happy to chat with you and guide you in dealing with your debt.

About Debt Solutions

Debt Solutions is part of National Debt Relief We are a private company offering debt advice and solutions for people in debt. We will talk you through the options that are available to you. If you decide to go for one of our solutions there will be a charge for this service - Fee informationYou can get free debt advice from MoneyHelper – an organisation set up by the Government to offer free and impartial advice to those in debt. Click here for more information